CHINA AVIATION MARKET

Flight Data for China

Explore Chinese Flight Statistics | May 2025

Flight data insights and aviation analysis focused on China's airline market , with data powered by OAG's Schedules Analyser.

Track the Chinese aviation market through data insights including:

- The busiest airports

- Top Chinese airlines

- The busiest domestic air routes in China

- China's biggest cities for air capacity

- The top 20 countries Chinese travellers fly to

- And more

The data is updated monthly. Seats are calculated as departing seats (one-way). The data displayed in the charts below is available to download here.

TOP 10 BUSIEST AIRPORTS IN CHINA | May 2025

Which are China's biggest airports?

- Baiyun International (CAN) remains China's busiest domestic airport this month, with 3.3m seats, a 4% increase in capacity vs last year..

- Shenzhen (SZN) and Beijing Capital (PEK) airports are a close second and third busiest airports, with 3.1m and 3m seats respectively.

- Capacity is increasing at the fastest rate of 6% at Beijing Daxing Intl.

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

TOP 10 DOMESTIC AIRLINES IN CHINA | May 2025

What are China's Top Airlines?

- China Southern Airlines and China Eastern Airlines are the busiest airlines, both continuing to represent 15% of the domestic market with 10.67m and 10.64m seats respectively in May 25.

- Whilst China Eastern's capacity has increased by 4% vs May 24, China Southern's capacity has reduced by 2% vs last year.

- Percentage wise, Spring Airlines has made the biggest increase in capacity vs last year, with a 16% increase in domestic capacity vs May 24.

- Within the Top 10 busiest airlines, four of the five carriers who reduced capacity last month vs last year have continued to take out capacity. Juneyao Airlines declined fastest by 11%, followed by Shenzhen and Shandong Airlines by 4%.

TOP 10 BUSIEST AIRLINE ROUTES IN CHINA | May 2025

Which are the Most Flown Airline Routes in China?

- Beijing Capital Airport to Shanghai Hongqiao (PEK-SHA) remains China's busiest route with 667,100 seats, constant with last year's capacity.

- The Guangzhou to Shanghai Hongqiao (CAN-SHA) route continues to decline at the fastest rate of 14%.

- Capacity on the Guangzhou to Beijing Capital (CAN-PEK) route and Chengdu to Shenzhen (CTU-SZX) route have both increased at the fastest rate of 7% this month.

CHINA'S BUSIEST CITIES BY AIRLINE CAPACITY | May 2025

Which Chinese Cities are Key For Air Travel?

- Beijing remains the busiest city this month with 5.4m seats through the 2 main airports, up 3% vs May 24.

- Capacity at Shanghai, the second busiest city with 4.7m seats, has increased by 2% vs last year.

- Within the top 10, Wuhan was the only city not to increase capacity, it remained constant vs last year.

DOMESTIC VS INTERNATIONAL AIRLINE CAPACITY | May 2025

How Much of Chinese Airline Capacity is Domestic?

- Domestic capacity accounts for 91% of all seats to, from and within China this month, with international making up the remaining 9%.

- Whilst domestic capacity increased by 3% vs last year, international capacity grew by 15%.

DISTRIBUTION OF CHINA'S INTERNATIONAL AIRLINE CAPACITY BY COUNTRY | May 2025

Which Countries do Chinese Travellers Visit?

- Japan is the busiest international market with 1.1m seats. It has now recovered and exceeded 2019 levels, with a 43% increase in capacity vs last year.

- North East Asia markets of the Republic of Korea and Hong Kong are the next busiest international markets with 905,300 seats and 635,500 seats.

- International capacity continued to recover strongly to Viet Nam, Japan and Malaysia, increasing by 62%, 43% and 32% respectively.

- In contrast International capacity reduced by 25% to Thailand, driven by safety concerns, competition from other South East Asian destinations and encouragement by the Chinese government for domestic travel coupled with the development of domestic attractions.

TOP 10 PROVINCES BY SEAT CAPACITY | May 2025

The table shows domestic capacity by Chinese Province for this month and the same month last year. domestic capacity has decreased by 3% vs May 24.

China's Largest Provinces for Air Capacity

- The largest Province for scheduled domestic airline capacity remains Guangdong Province, accounting for 8m seats which is 11% of all scheduled departing capacity in May 25. This represents a 5% increase in capacity compared with May 24..

- Guangdong has 2.6m more seats than Beijing province, the second biggest province with 5.4m seats.

- Domestic capacity continues to reduce by 2% in Shandong Province.

- The Top 10 Provinces remains unchanged and account for 60% share of domestic capacity.

MORE RESOURCES FROM OAG

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

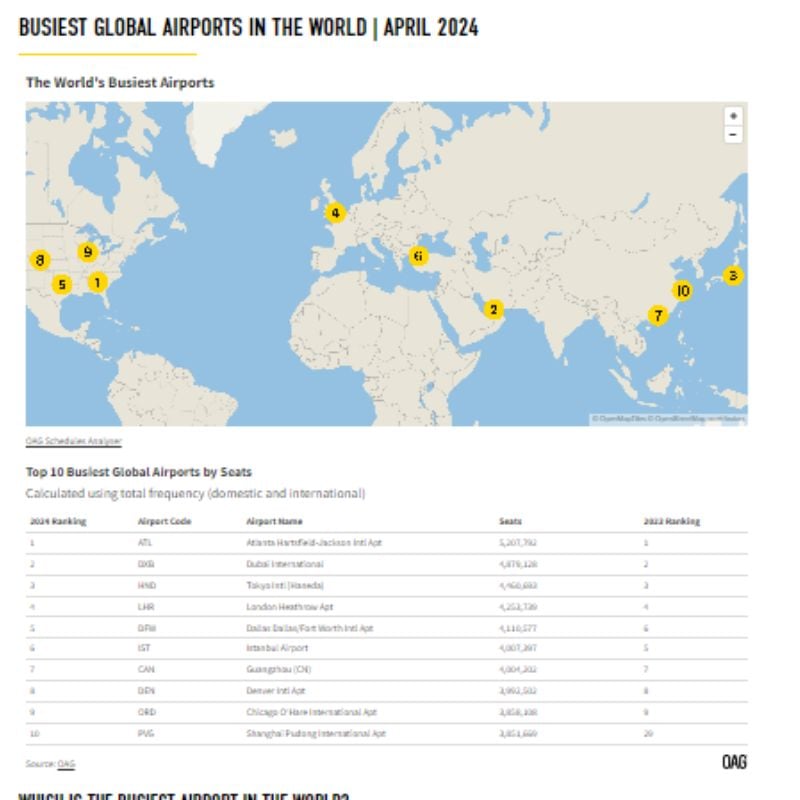

Busiest Airports

Data and analysis on the busiest global, international and regional airports, updated monthly.

View Data

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now